We invest in future-oriented industries with high growth potential.

Winify AG focuses on investments in sectors with above-average growth potential and sustainable business prospects.

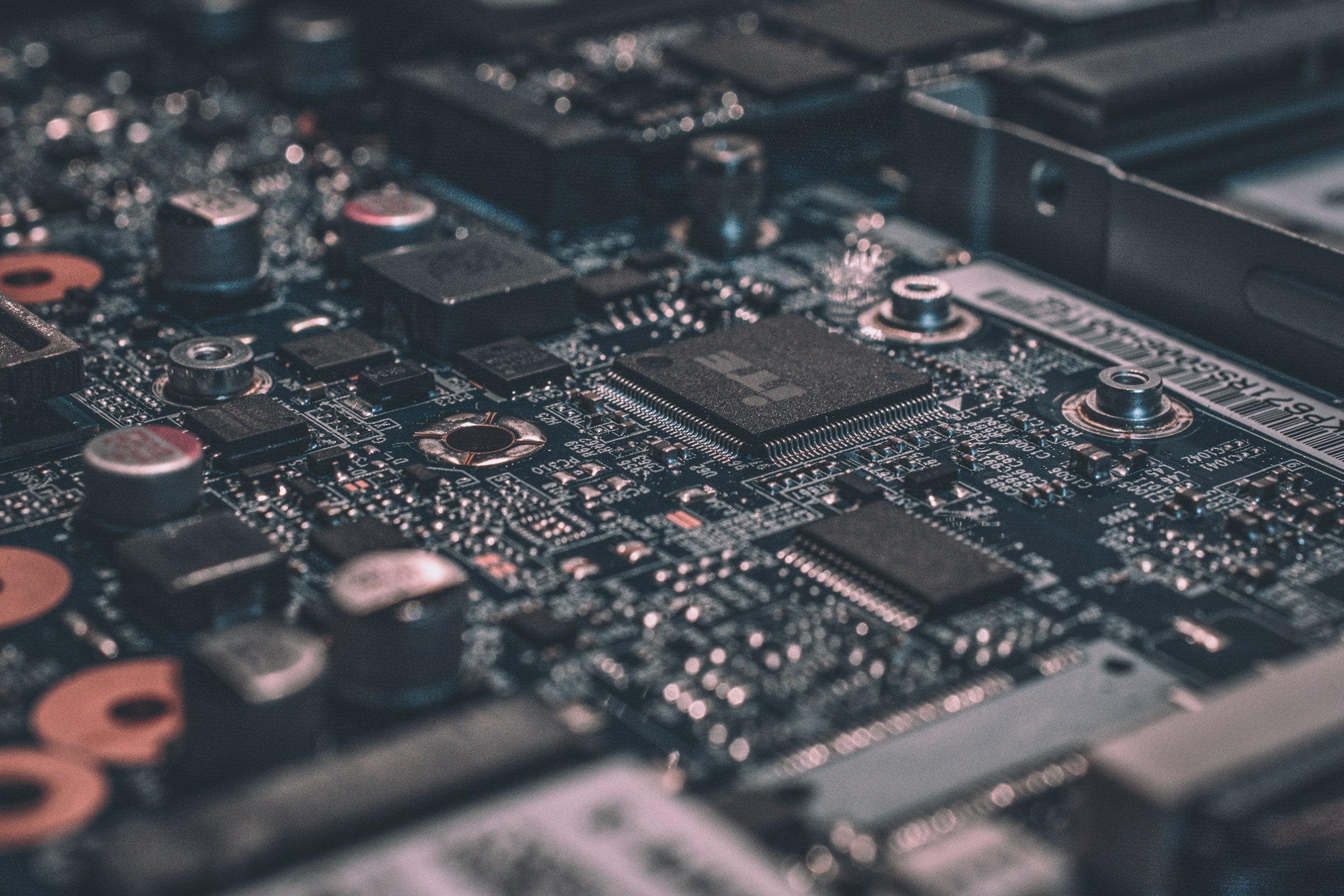

The technology sector remains a driving force for innovation and growth. We invest in forward-looking software, AI solutions, cloud technologies, and platforms that digitize and transform traditional industries.

500,000 Euro to 5 million Euro

Given the global challenges of climate change, we are strongly committed to sustainable technologies. We support companies that develop innovative solutions to environmental problems and contribute to the energy transition.

1 million Euro to 10 million Euro

The healthcare sector offers enormous opportunities for innovation and growth. We invest in companies that improve patient care, achieve medical breakthroughs, and make healthcare more efficient.

2 million Euro to 15 million Euro

The financial industry is experiencing a profound digital transformation. We invest in innovative fintech companies that redefine traditional financial services and democratize access to financial products.

1 million Euro to 8 million Euro

Online commerce continues to grow and is changing consumer behavior worldwide. We invest in innovative e-commerce companies and digital platforms that open up new market opportunities.

500,000 Euro to 7 million Euro

Sustainable consumption is becoming increasingly important. We invest in innovative companies that develop environmentally friendly products and promote sustainable consumption.

500,000 Euro to 5 million Euro

Our approach for successful investments across all categories.

We analyze hundreds of companies to identify the most promising candidates that meet our strict investment criteria.

We are active investors who bring their network, industry knowledge, and operational support to accelerate growth.

We take a long-term approach and work closely with management teams to create sustainable value.

If your company fits into one of our investment categories and you are looking for strategic capital, contact us.